That will be the next thing to sell on Kijiji. I decided I didn’t want to spend my life on the sofa in front of video games so I removed that addiction.

I played for five hours before realizing how much time had passed. I couldn’t sleep the other night so I got up and figured I’d play some games for a bit. One thing I did do was to erase and disconnect my Xbox. I assume it’s because I’m spending so much time doing renovations at the store that I haven’t paid any attention to ridding the house of unnecessary things. My kijiji sales have dropped dramatically.

Only 200,000 more months and I’ll be able to retire. I did receive my first dividend payment from my Yield Shield investments recently. It feels like I’m not making any progress lately.

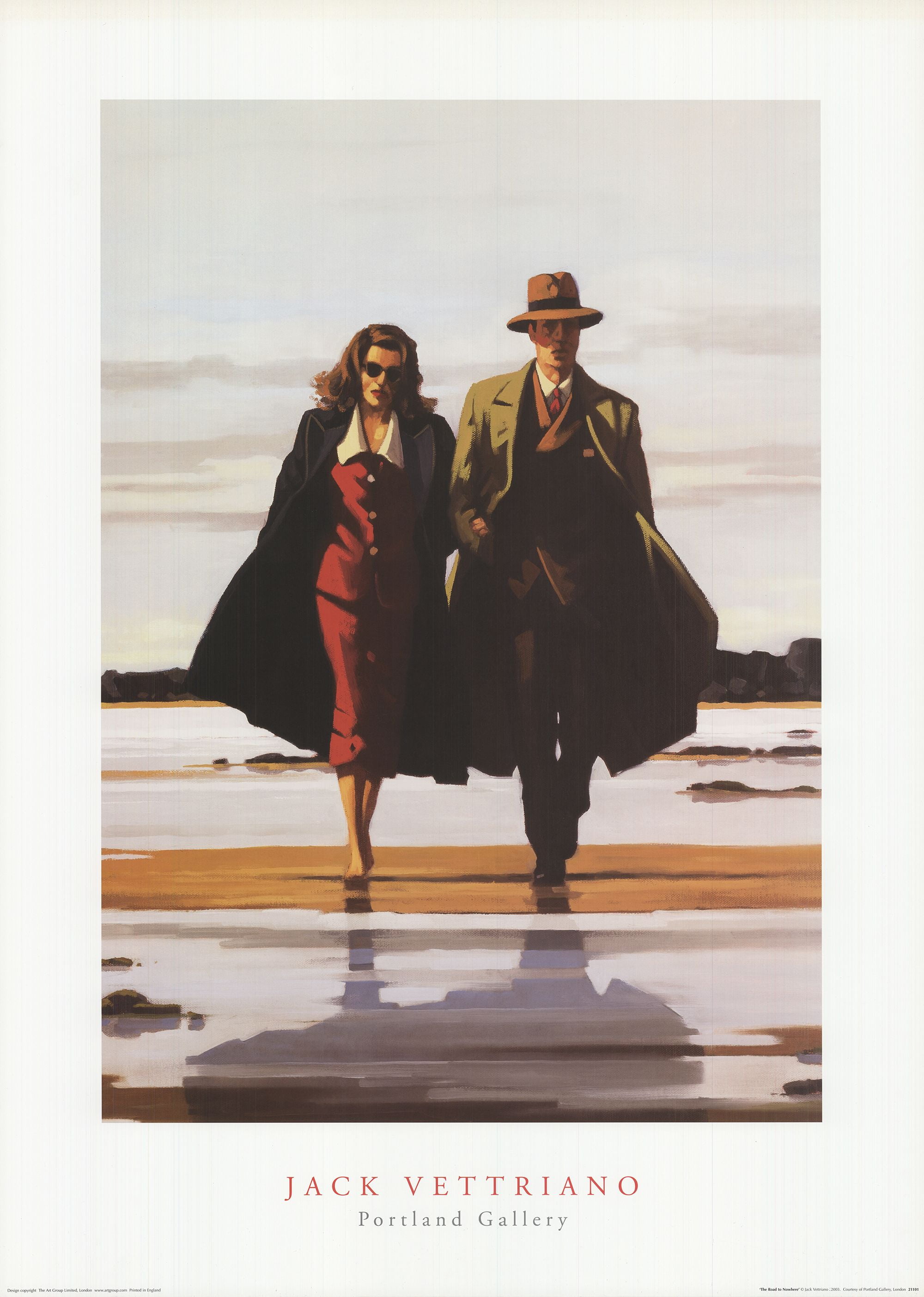

#My road to nowhere update#

Hopefully my next update is more positive. I will redouble my efforts and get back on track. Spending less money on eating out is definitely apparent in my health. I’m trying to stay as active as I can, even through the pain I feel all the time. I’m not going to complain about that, it’s a minor negative to a great positive. Unfortunately, this means I’ve had to buy new pants. I’ve also dropped 20 pounds over the past three months. I know we’re not supposed to have any investments until all the debt is paid off, but it feels good psychologically to see some progress there. We’re up to $12,000 in investments over the past four months, making good progress. Our payments have gone down dramatically and our savings have gone up. A minor setback in the grand scheme of things. Alright, set up a payment schedule to get that taken care of as well. We started having a little celebration until Carolyn says, “What about my Line of Credit?” Ah crap, I forgot about that. On a good note, we’ve paid off our credit cards – yay. I can use this to gradually drop the bad habits and develop new good ones.

#My road to nowhere how to#

It talks about how to develop new habits by adding very small changes to your normal routine. It was actually quite good, I think I may start implementing some of the strategies suggested. No point lamenting about it,I suppose, I’ll only make myself depressed. I spend a lot of time watching shows with Carolyn and playing on my computer, this time could definitely be spent preparing my life for independence. These are all things that I tell myself to rationalize why I’m backsliding in my progress.

An all-inclusive resort would be ideal but they’re so expensive. We don’t want to spend a lot of money but we also don’t want to worry about all the extras. It’s hard to choose a place to go on vacation. The new COVID variants are out and rearing their ugly heads and we might have a new lockdown any day now. I know we can’t really afford it, but we need to get away for a little while. I’ll keep you posted on the financial recovery process.Ĭarolyn and I are thinking of going on vacation. Things are starting to look up, but it’s going to be a long road to get back to where I was before. I burned through all of my investments, savings, and credit card limits to keep the store open over the past year. Still a few renovations to go but, overall, the store is looking pretty great. This made it so I didn’t qualify for any government support during the pandemic. Because I expanded the store, our gross revenue actually went up even though our net income was way down. The government had programs to support small businesses but this support was based on gross revenue. I did expand my store during the pandemic which actually caused another issue. Between being forced to close the doors and only do online orders and curbside pickup, and having to lay off most of my staff, it’s been a stressful year. COVID-19 became a thing and brought my store to its knees. It’s been almost a year since my last update, and it’s been a hard one.

0 kommentar(er)

0 kommentar(er)